BFSI

Download

The integration of technology in banking and finance has transformed the industry, providing a more convenient, efficient, and secure experience for customers, while improving operational processes and reducing costs.

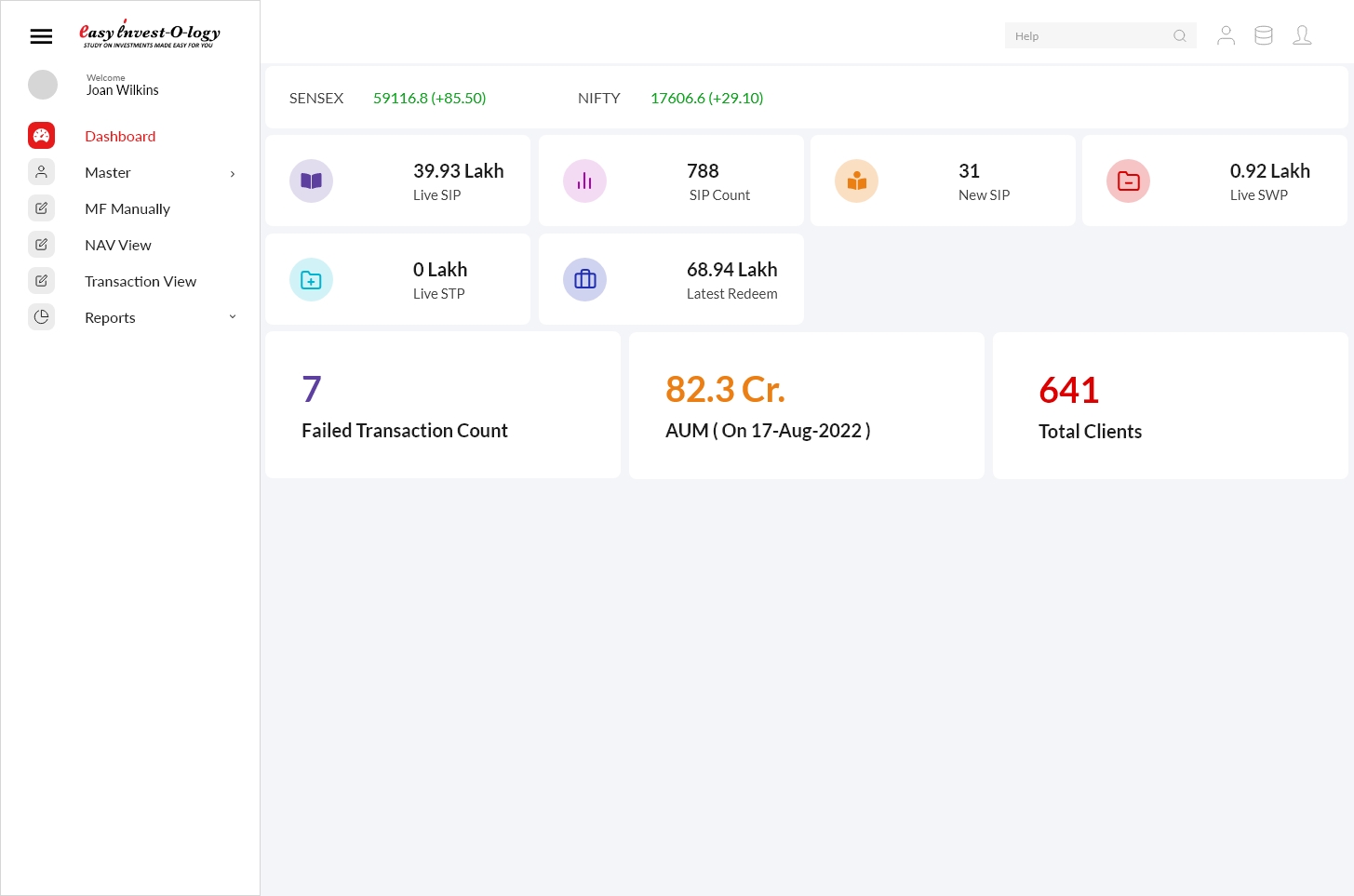

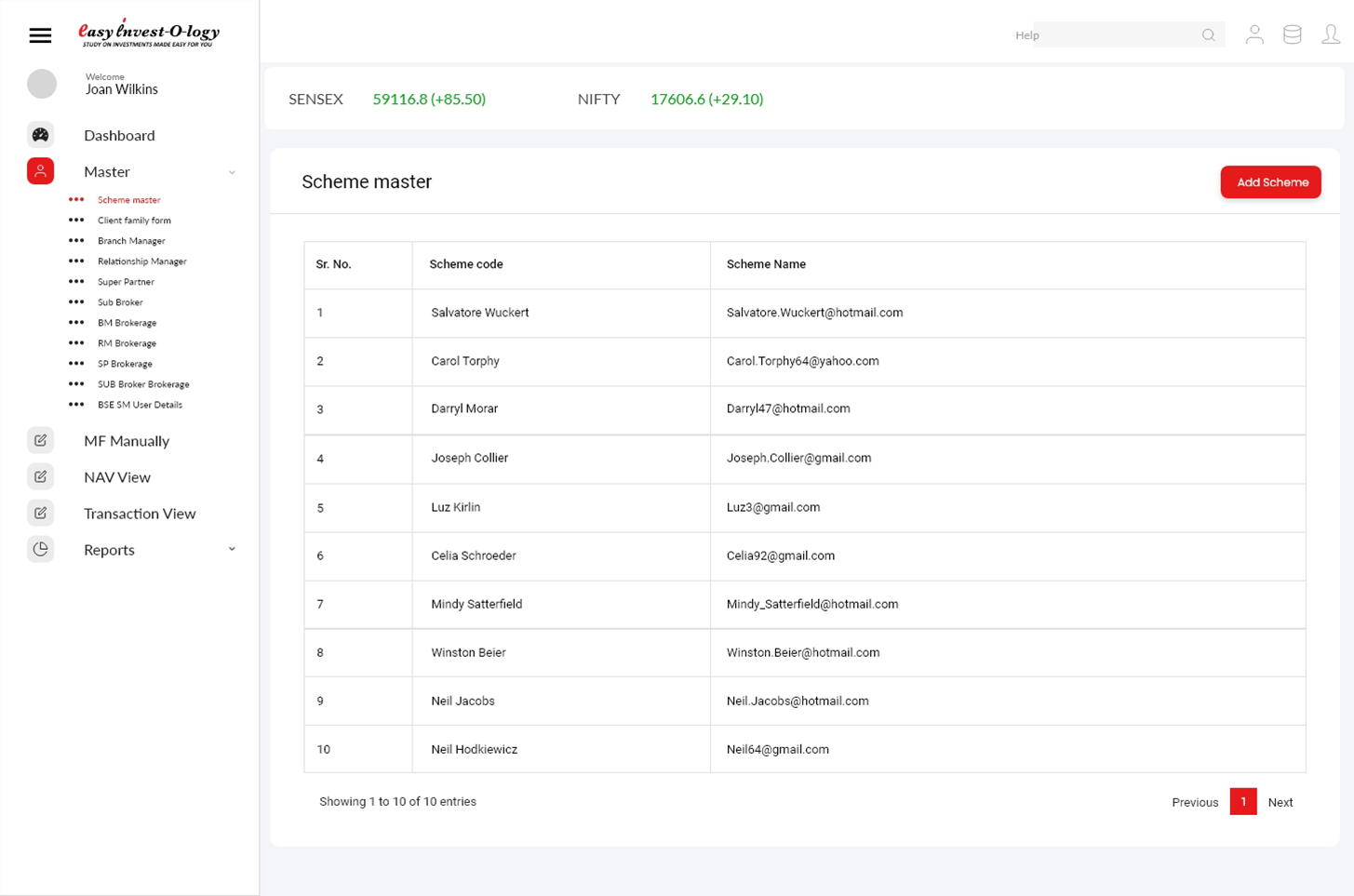

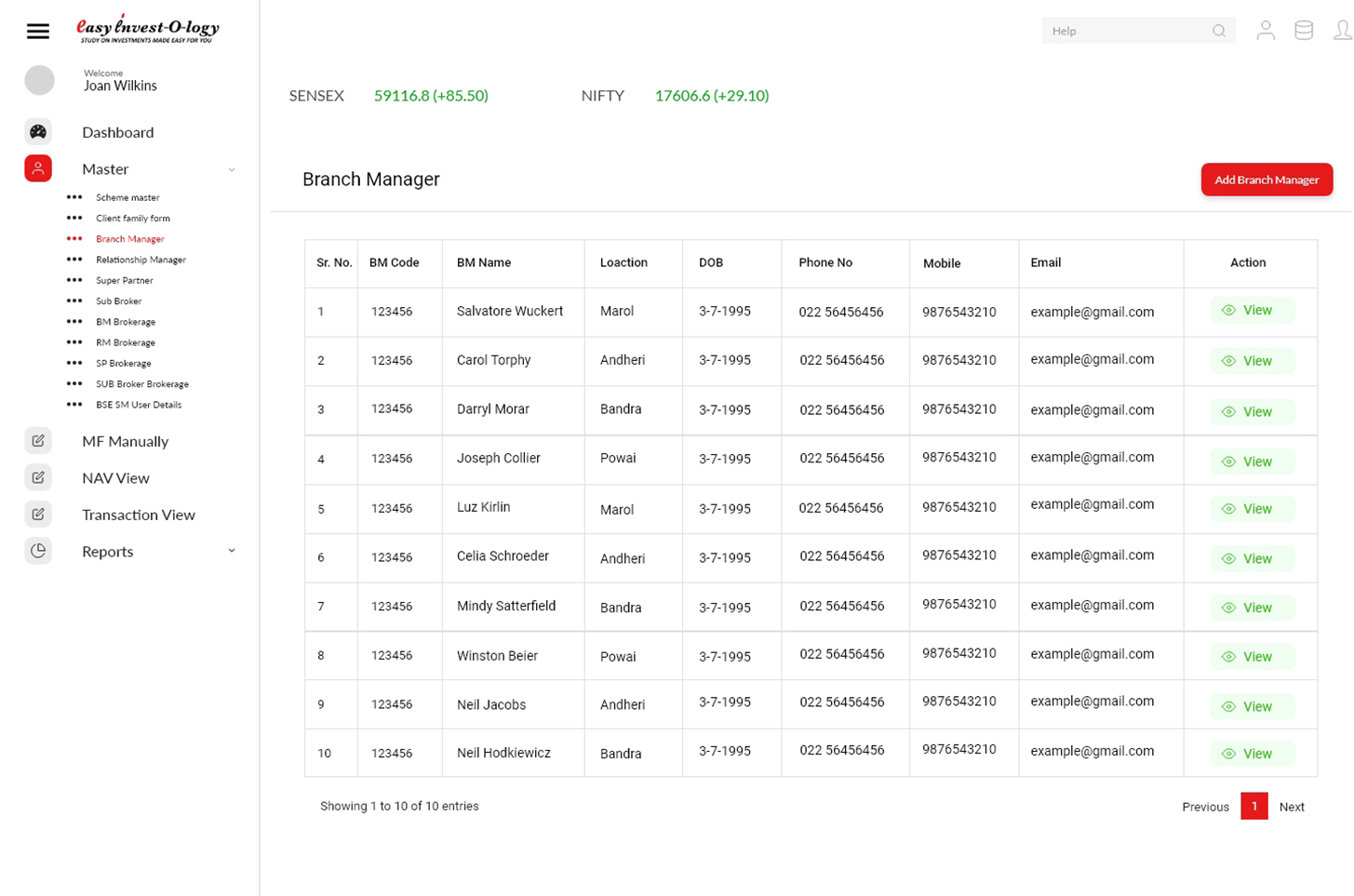

NON-CORE BANKING, FINANCE, INSURANCE BROKER.

Dynamic Vishva is very well versed with its ease and friendly use in a crucial segment of BFSI especially in accounts and finance. We have delivered successful applications for various purposes related to the field, by addressing the existing complexity & non-friendly systems.

Dynamic Vishva is very well versed with its ease and friendly use in a crucial segment of BFSI especially in accounts and finance. We have delivered successful applications for various purposes related to the field, by addressing the existing complexity & non-friendly systems.

Department Automized & Optimized

The solution primarily deals with the above departments to ensure more optimisation of resources and save time. We have successfully achieved visibility, countable results of leads, calculation, transparency, security, ease of operations.

Our Approach

1.

Identify the problem

Begin by defining the problem we gathered our focus to solve. Created the right questionnaire to different stakeholders. This helped us clearly understand the problem and will help us define the scope of the project and develop a focused solution.

2.

Understanding Generic Competition

Understanding the competitive environment gave the right and needful approach to deal with the segment solution for the purpose of productivity and efficiency.

3.

Define the user experience

Identify the different user groups that will be using the application, such as customers, bank employees, financial advisors, and regulatory authorities. Create user personas to understand their needs and behaviors, and use this information to design an intuitive and seamless user experience.

4.

Develop the system architecture

Once you have a clear understanding of the problem and user needs, develop the system architecture. This includes defining the database schema, API architecture, and user interface components.

5.

Design the database schema

Design a database schema that can efficiently store and manage information such as customer profiles, financial transaction data, and regulatory compliance data.

6.

Develop/Ensure APIs

Develop APIs that can be used by both the web application and mobile applications. APIs should be designed to be scalable and performant, with clear documentation and error handling.

7.

Develop the user interface

Design a user interface that is easy to use and visually appealing. Ensure that the interface is optimized for different device sizes and that it follows best practices for accessibility.

8.

Incorporate relevant features

Identify the features that are most relevant for the banking, finance, and insurance segment, such as online banking, mobile payments, financial planning and analysis tools, risk management tools, and regulatory compliance tools. Incorporate these features into the application design to make the solution more useful and efficient.

9.

Ensure security and privacy

Implement appropriate security measures to protect sensitive data related to financial transactions, customer profiles, and regulatory compliance.

10.

Integrate with existing systems

Ensure that the solution can integrate with existing financial systems and technologies, such as payment gateways, accounting software, and customer relationship management tools.

11.

Test and refine the application

Test the application thoroughly to ensure that it meets the needs of users and that it is scalable and performant. Refine the application based on user feedback and continue to iterate until you have a solution that meets the needs of all stakeholders.

Our products make us proud

Results

20%

Time Saved

30%

Productivity

10%

New Business Generation

25%

Efficiency

30%